The Texas Patriots PAC Urges You To Support The Residents First MUD Board Candidates

Early Voting

Monday, April 22 - Saturday, April 27 - 8:00am - 5:00pm

Monday, April 29 - Tuesday, April 30 - 7:00am - 7:00pm

Election Day

Saturday, May 4 - 7:00am - 7:00pm

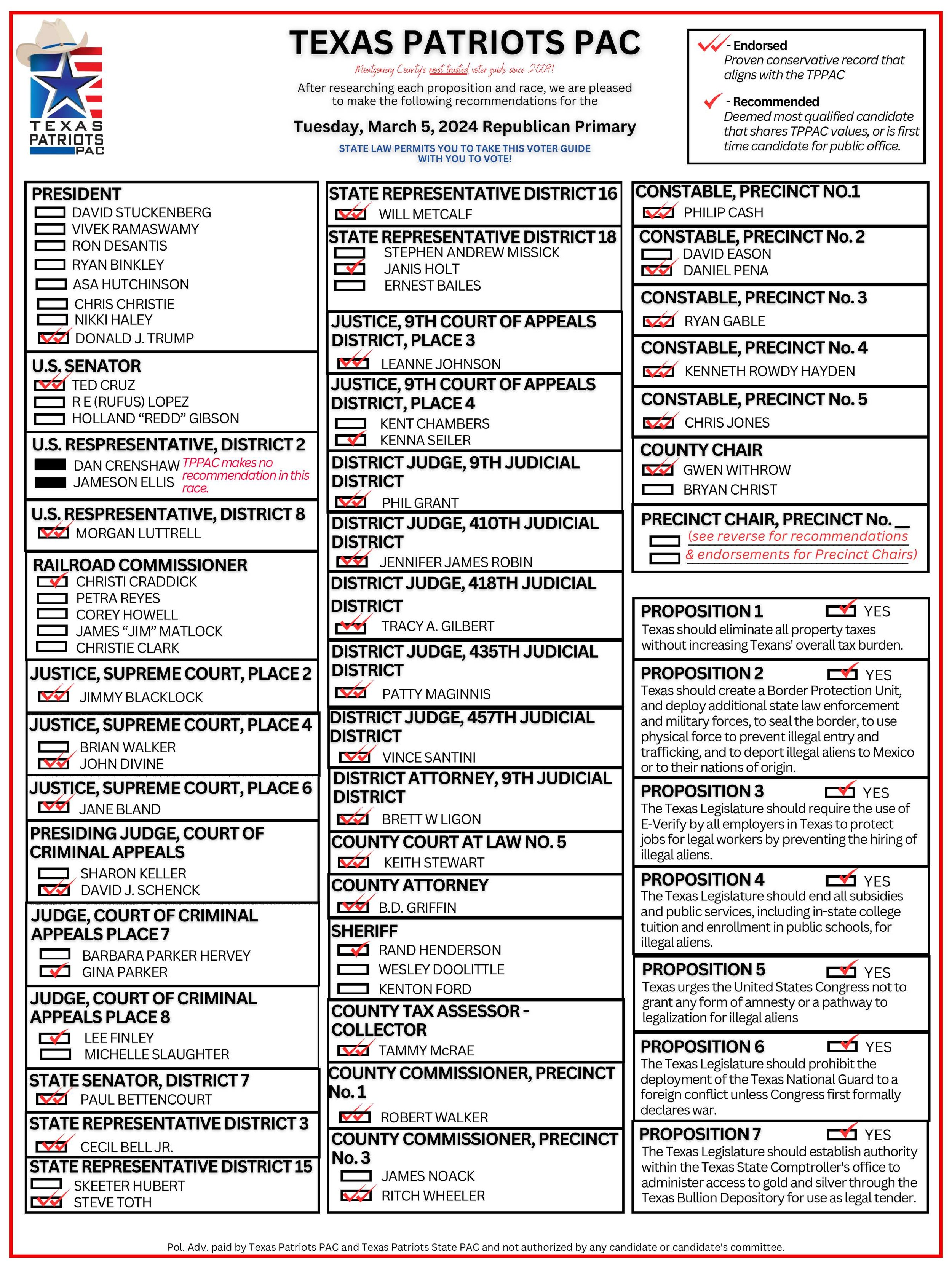

TEXAS PATRIOTS PAC VOTER GUIDE

Early Voting (Feb 20 - Mar 1) ; Election Day for PRIMARY is MARCH 5th 2024

FIND YOUR MONTGOMERY COUNTY PRECINCT AND VOTING LOCATION FOR ELECTION DAY BY CLICKING HERE

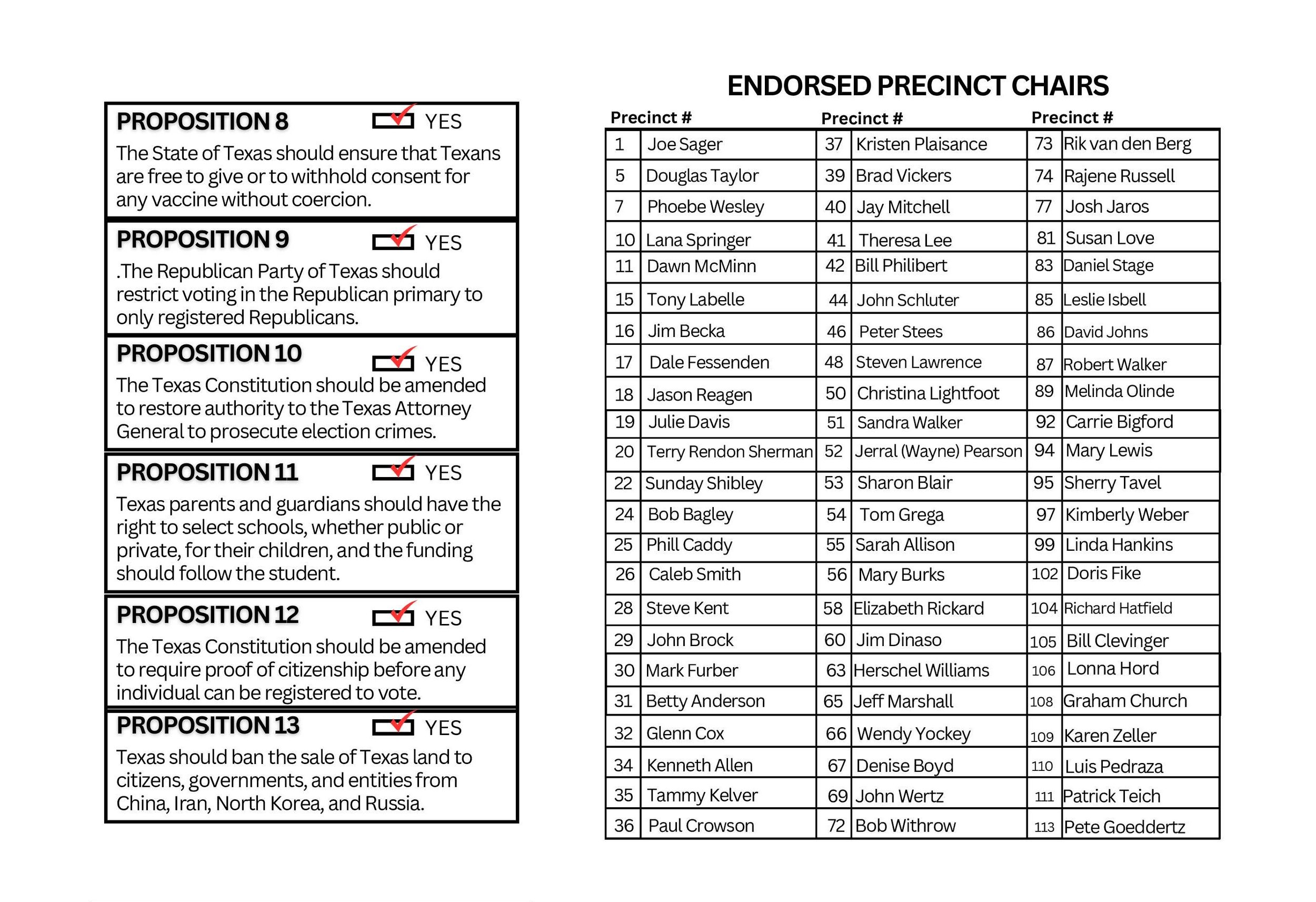

Use links below to print a copy of your WOODLANDS - MONTGOMERY COUNTY VOTER GUIDE to take with you inside the polls. Paper copies are allowed inside the election booth; referring to your PHONE IS NOT ALLOWED inside the Election Booth.

Montgomery County ELECTION DAY Voting Locations & Times

Montgomery County EARLY Voting Locations & Times

Click Below to Print a PDF Voter Guide to bring to the polls.

Texas Patriots PAC is for Constitutionally Limited Government; Fiscal Responsibility; and Free Markets. To uphold these principles, we recommend a vote for all Republicans in the contested partisan races. The Democrat party has become extreme with their antics and lack of moral discernment.

Clint Eastwood - Pale Rider